Have you ever asked yourself, “What is forex?” You are not alone. Many people hear about forex but do not know how it works. Today, you will find all the answers. In this guide, we will explain forex in a very simple way.

The forex market is the biggest in the world. Every day, people buy and sell money from different countries. They do this to make a profit. Some lose money, too. That is why you must first understand the basics.

Also, this guide will give the answer to ‘what is Forex?’, but it will reveal deep insider secrets that most new traders do not know, and many expert traders refuse to tell their students or others. You will also learn the simple steps to start. You will also discover what mistakes to avoid. Plus, you will get tips that will save you time and money.

So, if you want to know all about the answers to ‘what is Forex,’ and start forex trading and succeed, then you must keep reading. This is the best place to learn. Let’s go right in and leverage the world of forex together!

What is Forex or FX?

:max_bytes(150000):strip_icc()/GettyImages-1358049777-bd1443f8ea0240a2b949ce129e7d1894.jpg)

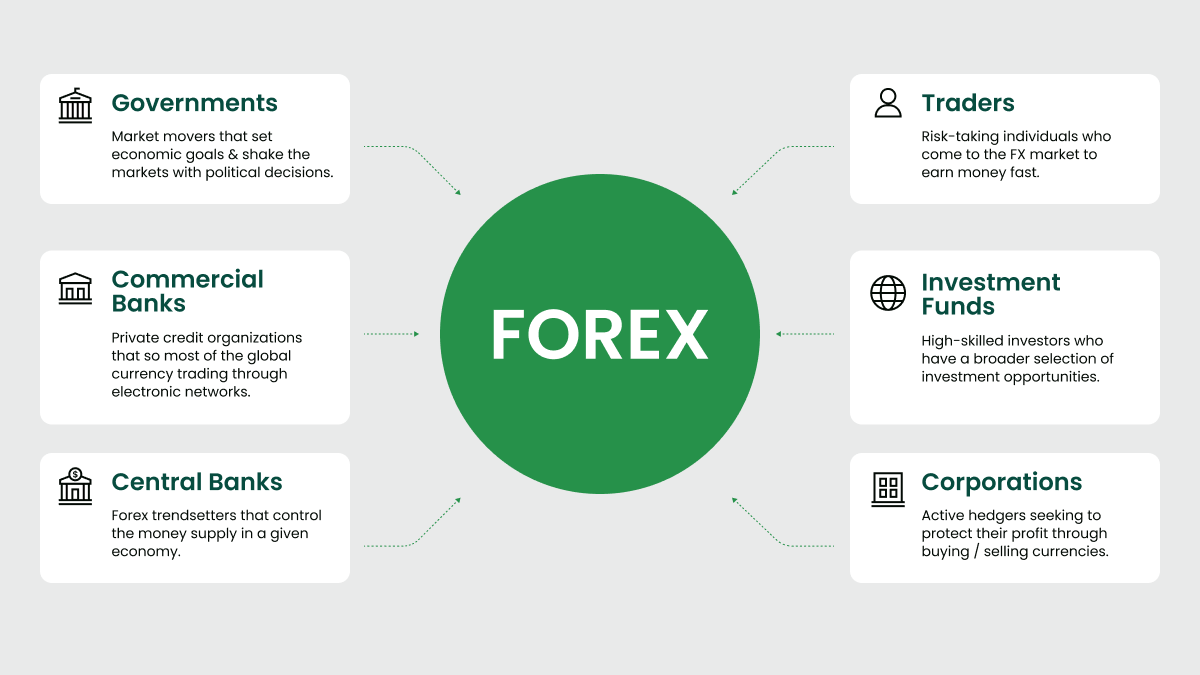

The foreign exchange market, often called forex or FX, is a worldwide marketplace where people trade one country’s currency for another. It stands as the biggest and most liquid market across the globe, with trillions of dollars being exchanged daily.

There is no central location where this trading happens, and no single government controls it. Instead, forex operates through an electronic network made up of banks, brokers, large investors, and individual traders, most of whom participate through brokerages or banks.

Understanding Forex

The forex market helps set the daily value, or exchange rate, for most currencies around the world. For example, when a traveler swaps U.S. dollars for euros at a bank or money exchange, the amount of euros they receive depends on the current forex rate.

Moreover, if imported French cheese becomes more expensive at the store, it could be a sign that the euro has grown stronger against the U.S. dollar because of forex trading activities.

Forex traders aim to make money by taking advantage of the frequent changes in currency values. For instance, if a trader believes the British pound will rise in value, they will exchange their U.S. dollars for British pounds. Later, if the pound indeed gains strength, they can reverse the trade, ending up with more dollars than they started with.

Forex Trading

Forex trading, also known as foreign exchange trading or simply FX trading, is the process of switching one currency for another. FX represents one of the most heavily traded financial markets in the world, with individuals, companies, and banks handling about $6.6 trillion worth of transactions every day.

Even though a significant portion of currency exchange happens for practical reasons, most of it is carried out by traders aiming to earn a profit.

Since a huge amount of currency is exchanged each day, some currencies can experience very sharp price changes, which is a factor that anyone thinking about starting forex trading should carefully consider.

The Fundamentals/Essentials of Forex Trading for Beginners

What is a Forex Pair?

In forex trading, currencies are always presented in pairs, and a forex pair is simply two currencies that are traded against each other. There are hundreds of possible pair combinations, but some of the most commonly traded ones include the euro versus the U.S. dollar (EUR/USD), the U.S. dollar versus the Japanese yen (USD/JPY), and the British pound versus the U.S. dollar (GBP/USD).

Each currency pair has a price attached to it, like 1.2569. For example, if you are looking at the USD/CAD pair, this price means it costs 1.2569 Canadian dollars to purchase one U.S. dollar. If the price moves up to 1.3336, it now takes 1.3336 Canadian dollars to buy one U.S. dollar. This change shows that the U.S. dollar has gained strength against the Canadian dollar because now you need more CAD to get one USD.

In the forex world, currencies are traded in groups known as lots, and there are three common types: micro, mini, and standard lots. A micro lot is worth 1,000 units of the base currency, a mini lot is worth 10,000, and a standard lot amounts to 100,000. Trades happen in fixed blocks of currency. For instance, a trader might trade seven micro lots (7,000 units), three mini lots (30,000 units), or even seventy-five standard lots (7,500,000 units).

Forex trading typically involves huge trading volumes. Based on data from the New York Federal Reserve, the average daily turnover in over-the-counter forex instruments went beyond $1.165 trillion in April 2024. The biggest trading hubs around the world are London, New York, Singapore, Hong Kong, and Tokyo.

What are the Base and Quote Currencies?

In every currency pair, the base currency is always listed first, while the quote currency is listed second. The base currency is always valued at one unit, and the quote currency shows how much it takes to buy one unit of the base currency. When trading forex, you are always selling one currency to buy the other.

What is a Pip in Forex?

A pip in forex trading usually refers to a one-digit move at the fourth decimal place in most currency pairs. For example, if GBP/USD shifts from $1.35361 to $1.35371, that counts as a one-pip movement. However, when trading pairs involving the Japanese yen, a pip occurs at the second decimal place instead. Furthermore, any movement at the fifth decimal place is known as a pipette.

What is a Lot in Forex Trading?

Currencies are exchanged in lots, which are set quantities used to keep forex trades standardized. Since currency price shifts are typically quite small, the lot sizes are large. For example, a standard lot represents 100,000 units of the base currency.

You can watch the video below to learn more on ‘what is forex trading?’:

How Does Forex Trading Work?

The forex market operates 24 hours a day and five days a week, across the entire globe. In the past, the foreign exchange market was mainly for governments, big corporations, and hedge funds. However, nowadays, trading currencies is very simple and just a mouse click away. Many investment firms now offer platforms where individuals can easily open accounts and trade currencies.

This is not the same as visiting a money exchange booth. Everything happens electronically, with no physical swapping of cash between people. Instead, traders take a position on a particular currency, hoping that its value will rise if they are buying, or fall if they are selling, so that they can make a profit.

There are a few key differences between forex trading and trading in other markets. First, there are fewer rules in forex, meaning investors do not have to follow the strict guidelines found in stock, futures, or options markets. There are no clearing houses and no central organizations that supervise the forex market.

Second, because trading does not happen on a traditional exchange, there are fewer fees and commissions compared to other markets. Also, there are no fixed trading hours, so you can trade whenever you want since the market is always open during the week.

Lastly, due to the market’s high liquidity, you can easily enter and exit trades whenever you wish, buying as much currency as your budget allows.

Forex trading works similarly to any transaction where you use money to buy an asset. In forex, the market price tells you how much of one currency you will need to buy another. For example, the GBP/USD market price shows how many U.S. dollars you would need to purchase one British pound.

Each currency is identified by a special code, making it easy for traders to recognize currencies in pairs. Here are some codes for the most commonly traded currencies.

| Currency | Code |

|---|---|

| US Dollar | USD |

| Euro | EUR |

| British Pound | GBP |

| Japanese Yen | JPY |

| Swiss Franc | CHF |

| Canadian Dollar | CAD |

| Australian Dollar | AUD |

What Does It Mean to Buy or Sell a Currency Pair?

Buying a currency pair means you expect its price to increase, meaning the base currency is getting stronger compared to the quote currency. Selling a currency pair means you believe the price will go down, showing that the base currency is weakening against the quote currency.

For instance, you would ‘buy’ the GBP/USD pair if you believe the British pound will become stronger compared to the U.S. dollar, which means it would take more dollars to buy one pound. On the other hand, you would ‘sell’ the GBP/USD pair if you think the pound will weaken, meaning fewer dollars would be needed to purchase a pound.

What Is the Spread in Forex Trading?

In forex trading, the spread is the gap between the buying and selling prices. For instance, the buy price might be 1.3428 while the sell price could be 1.3424. To make a profit, the market price needs to move above the buy price if you are going long, or below the sell price if you are going short.

What Are Margin and Leverage in Forex Trading?

Margin is the amount of money you must deposit to open and maintain a position using leverage. For example, if you are trading the EUR/USD pair, you might only need a margin of 0.50% to start the trade. This means that instead of putting up $100,000 to open the position, you would only need to deposit $500.

Other Forex Terms You Should Know About

There are several other key terms that forex traders commonly use, which are:

- Going long: Purchasing a currency with the expectation that its value will rise within a few hours, allowing it to be sold later for a profit.

- Going short: Selling a currency with the belief that its value will decline, enabling it to be bought back at a lower price.

- The ask: The price at which a trader is willing to buy a currency pair.

- The bid: The price at which a trader is willing to sell a currency pair.

Why Do People Trade Forex? – Insider Secrets You Must Know Before Forex Trading

:max_bytes(150000):strip_icc()/GettyImages-2124055337-cd8340a38ab04b32860aa71dea422d30.jpg)

1. Predicting Currency Strength or Weakness

Traders engage in forex by predicting how one currency will perform compared to another. They aim to profit when one currency strengthens or weakens against its pair.

If the price of a currency pair increases, it indicates that the base currency is getting stronger against the quote currency. Conversely, when the price falls, the base currency is weakening relative to the quote currency.

This happens because when the price rises, it requires more of the quote currency to buy one unit of the base currency, and when the price decreases, it takes fewer of the quote currency to purchase a unit of the base. As a result, traders are likely to take a long position if the base is strengthening or a short position if it is weakening.

Popular forex trading strategies include scalping, day trading, swing trading, and position trading. The choice of strategy typically depends on whether the trader is focused on short-term or long-term goals.

2. Hedging in Forex

Hedging is a strategy used to reduce potential risk. It involves opening positions that could profit if other positions lose value, with the idea that the gains from the hedge will balance out some of the losses. Currency pairs that are correlated, like EUR/USD and GBP/USD, are often used for hedging purposes.

For example, if you hold a long position on EUR/USD, you might short GBP/USD to protect yourself from potential declines in the market.

3. Opportunity Available Around the Clock

The forex market operates 24 hours a day due to the interconnected network of banks and market makers that constantly trade currencies. Major trading sessions occur in the U.S., Europe, and Asia, and the time differences between these regions ensure that the market is open throughout the day and night.

This 24-hour availability of the forex market is one of its key advantages, allowing traders to take advantage of opportunities at any time. Additionally, some brokers offer weekend trading on certain currency pairs, including GBP/USD, EUR/USD, and USD/JPY, enabling traders to trade when most other markets are closed.

You can watch the video below to see more on insider secrets on forex trading you need to know:

What Influences the Forex Market?

The forex market consists of currencies from all over the globe, and many different factors can influence exchange rate fluctuations. Here are some of the key factors that impact the forex market:

- Central Banks

Central banks control the supply of their country’s currency and can implement policies that significantly affect the value of the currency. For instance, quantitative easing, which involves increasing the money supply, can lead to a decline in the currency’s price due to the higher supply. - News Reports

Investors and commercial banks are generally drawn to economies with positive outlooks. Therefore, if favorable news about a specific region is released, it can attract investment and boost demand for that region’s currency. On the other hand, negative news tends to lower demand for a currency as investor confidence decreases. As a result, currencies often mirror the economic health of the regions they represent. - Market Sentiment

Market sentiment, which often reacts to news events, plays a significant role in driving currency prices. If traders believe a currency will rise or fall, their collective actions can influence others to follow, thereby increasing or decreasing the currency’s demand.

Pros and Cons of Forex

The Pros

One of the main benefits of the forex market is its high liquidity, meaning there is always a large volume of transactions occurring. This ensures that traders can enter and exit positions with minimal price movement.

Since the market operates worldwide and is open 24 hours a day on weekdays, it provides flexibility for traders to engage at any time, regardless of their time zone.

Another positive aspect of forex is its low transaction costs. Unlike stock markets, where brokers may charge higher fees or commissions, forex brokers typically earn money from the difference between the buying and selling prices of currency pairs, which makes trading more affordable, especially for those who trade frequently.

Additionally, many forex brokers offer leverage, enabling traders to control a larger position with a smaller investment, increasing their profit potential.

Lastly, the forex market offers easy access to a variety of currencies, allowing traders to diversify their portfolios. With so many available currency pairs, traders can hedge against risks or take advantage of global economic events to make profits.

The market is also very transparent, as economic news and information are readily available, helping traders to make well-informed decisions. This wide accessibility and variety of choices make forex trading appealing to both newcomers and experienced traders.

The Cons

The primary disadvantage of forex trading is the high risk involved, particularly when using leverage. While leverage can boost profits, it can also magnify losses. Traders may end up losing more than their initial investment if the market moves against them, leading to substantial financial losses.

Another drawback is the complexity of the forex market. Understanding how different currencies interact and the factors that affect exchange rates takes time and expertise. Unlike stocks, where analyzing a company’s value is more straightforward, forex trading requires a solid understanding of global economic policies, interest rates, and geopolitical events, which can be overwhelming for beginners.

Finally, the forex market is often speculative. Traders tend to use short-term strategies, attempting to profit from small price changes. Without proper discipline and risk management, they may fall into a cycle of losses. Additionally, since the market operates around the clock, it can be tempting to overtrade or be overly active when it might be wiser to take a step back.

Jetxtrade Academy’s Advice

Now you know all the answers to “What is forex?” You also know how it works. This is the first step to becoming a smart trader.

Forex trading can be simple if you learn the basics. You must start slow. You must practice a lot. Always use what you have learned. Do not rush. Learn every day.

Also, remember the insider tips. They will help you avoid losing money. Always plan your trades. Never let your feelings control you. Always keep learning and improving.

If you are serious about trading, open a demo account today. Practice without using real money. Study the market every day. Use trusted sources and tools.

You can start small. You can grow with time. Your journey to forex success can start now. Take that first step and never stop learning!