Are you wondering how to trade forex with $50 to $100 without losing it all? You are not alone. Many beginners start small, and that is very smart. Small accounts help you learn without big risks.

But forex can be tricky. With small money, one mistake can wipe you out, and that is why you need a plan, and you also need good risk tools.

The good news is you can make real progress with $50 to $100. You just need the right method, and in this guide, you will learn step-by-step tips. You will also see how to protect your account.

If you want to grow slowly and steadily, keep reading. This article is your beginner’s blueprint, and it will help you trade smart, even on a tight budget.

Is It Really Possible to Start Forex Trading with $50 to $100?

Yes, it is possible. Many traders begin with small amounts, and you can start trading forex with just $50 to $100. But you must be careful.

You need realistic expectations. You will not become rich overnight. With $50, don’t expect to make $1,000 in one week. That is not safe, as the goal is to learn, grow slowly, and protect your money.

Many beginners believe false ideas. Some think small money grows fast with big trades, as that is risky and wrong. Others think they must trade every day, and that also leads to losses.

Here is a simple example:

You start with $100, you aim for 5% profit weekly, and that is $5 a week. In 10 weeks, you could grow to around $150, and that is slow, but safe. Over time, your account gets bigger, and then you can invest and risk more, and using good techniques, your profits grow too.

Now, you might be wondering why can’t I start forex trading with as little as $10? Now, this is where lot sizes come in, and we will explain what lot sizes are in the next section.

About Lot Sizes

Let’s keep this as easy to understand as possible.

If you’re new to trading, you might find the term “lot size” a bit tricky at first. But in reality, it just refers to how much of something you’re buying or selling.

You can think of it like getting a cake and the thing is that you could buy the entire cake, or you might just take a slice. That’s the basic idea behind different lot sizes.

In trading, a “lot” means a fixed amount of a currency that you’re dealing with. The lot size tells you how much of that asset you’re trading at once, which means that basically, it shows how large your trade is.

For example, in currency trading in forex, a standard lot is equal to 100,000 units of the main currency in the pair in most cases. So, if you decide to trade one full lot of EUR/USD, the most traded currency pair, you’d need about $110,000 or €100,000 to complete that trade.

There are also smaller lot sizes, listed below:

| Lot Type | Description |

|---|---|

| Standard Lot | The largest size, equals 100,000 units. |

| Mini Lot | One-tenth the size of a standard lot (10,000 units). |

| Micro Lot | One-tenth the size of a mini lot (1,000 units). |

| Nano Lot | The smallest offered by some brokers (100 units). |

The main point is that picking the right lot size helps manage your risk in each trade. Many beginners prefer to start with smaller sizes like micro or nano lots because it keeps their losses smaller while they’re still learning how trading works.

Now, back to your question on ”why can’t I start forex trading with as little as $10?”

The thing is that there is a recommended lot size which is ideal for a trading account, and you have to know what each of these lot sizes involves, and whether it meets your trading goals. From there, you will know whether it’s ideal to start forex trading with the amount you have in mind.

Now, What Lot Size Is Ideal for a Small Trading Account?

Below is a breakdown of what many top forex traders personally believe are the most fitting lot sizes depending on different account balances.

These are based on their own judgment, so feel free to adjust according to your comfort level. However, expert forex traders have chosen these options while keeping risk control in mind.

If you feel confident in your trading, you can always increase or reduce your lot size as needed.

1. Recommended Lot Size for a $10 Forex Account

Without Leverage:

For an account with just $10 and no leverage, the best choice is a micro lot.

Trading with a $10 balance and no leverage is extremely limiting. A micro lot, or 0.01 lots, equals $1,000 worth of currency. Since this requires more funds than your account holds, trading even the smallest standard lot isn’t really practical.

In fact, it’s almost impossible to trade properly under these conditions without access to leverage. A few brokers may offer unique account setups that allow smaller trades, but these are quite rare.

If you’d like to figure out how your position size affects cost, try using a forex spread calculator to see how spreads influence your profits or losses.

At this level, you’re mostly checking out the market rather than trying to earn. It’s recommended to risk only 1–2% per trade. That means risking $0.10 to $0.20 per trade, which is less than a micro lot.

If your broker supports it, use a nano account for better control. That’s why many traders with only $10 end up using leverage to amplify their gains.

With Leverage:

If your broker gives you 1:100 leverage, your $10 can control $1,000 in trades, and a micro lot becomes an option in this case. Still, because of the small balance, it’s safer to use even smaller sizes like 0.001 lots to reduce risk. A small 10-pip move could significantly impact your funds.

2. Recommended Lot Size for a $20 Forex Account

Without Leverage:

With $20 and no leverage, the best you can go for is still a micro lot.

You’ll have a little more freedom than with $10, but not much. The same rules apply here but micro lots are your upper limit, but even then, trading is very tight and not exciting. Stick to risking 1–2% of your total funds per trade, which is just $0.20 to $0.40.

Forex is volatile, so price swings can empty small accounts quickly if you’re not careful. Use tools like negative balance protection and try to use lot sizes smaller than 0.01, if your broker allows fractional trading.

With Leverage:

At 1:100 leverage, your $20 becomes $2,000 in buying power. Here, micro lots (0.01) are reasonable, but to be safer, it’s smart to trade with 0.005 lots or less to reduce exposure.

3. Recommended Lot Size for a $50 Forex Account

Without Leverage:

A $50 account should still stick to a micro lot because even at $50 with no leverage, trading is risky. You can just about manage 0.01 lots, but eep your risk per trade at 1–2%, or $0.50 to $1.

Don’t let a few wins tempt you to raise your trade size too fast, and make sure to keep trades small and controlled. You can use a forex compounding calculator to see how your account might grow slowly over time.

With Leverage:

With 1:100 leverage, you can trade up to $5,000 in value. Micro lots are again suitable, but this time you have more freedom to possibly add to winning trades. Based on how much a currency moves, it may be wiser to go slightly lower, such as 0.007 lots, just to stay safe. Check our guide on leveraging small accounts for more.

4. Recommended Lot Size for a $100 Forex Account

Without Leverage:

With $100 and no leverage, go with a nano lot, and a nano lot (0.001) gives you flexibility while keeping you safe. You can now risk $1 to $2 per trade while sticking to the 1–2% rule. You’ll have more room for minor losses, but that doesn’t mean you should gamble. Stick to smaller wins and strict risk rules.

With Leverage:

With 1:100 leverage, your $100 account can control $10,000 worth of trades. A micro lot (0.01) works well in this case, as it aligns with a $1 to $2 risk per trade. You now have a better mix of safety and opportunity.

You can watch the video below to know more about on lot sizes:

So, How Much is Really Recommended?

Many beginners in forex always ask what the flat line amount is recommended to start forex. To tell you the truth, that’s up to you. Reading the section above on the recommended lot sizes for small accounts, you can see the pros and cons of amounts ranging from $10 to $100.

So, the decision is really up to you based on what your forex trading goals are. However, based on research, forex trading experts recommend $100 to $250 as the amount for beginners to start trading in forex.

This is because these amounts give you some amount of flexibility to be able to trade with a good lot, afford more risks, and absorb losses, which means the higher, the better. So, this also means that if appropriate techniques are leveraged, this means you rake in more profits with these amounts than what a lesser amount will give you.

In forex trading, there is a well-known saying that goes; “The greater the risks, the greater the reward,” and you can only have the potential or capability to take big risks that will bring big profits when you use good risk-taking amounts, and that’s why top forex traders recommend $100 to $250.

However, don’t allow yourself to be pressured. Those same forex traders who recommend $100 to $250 will also advise you to take your time, learn the ins and outs of forex trading, understand the forex market, know all about leveraging at the right time, and start trading bit by bit.

With time, which is in no time, that’s if you are consistent, focused, disciplined, and dedicated, you will reach the level where you know exactly how to use any amount you have, and get what you want from your day-to-day forex trading.

So, for now, take it step by step. Don’t rush. Don’t feel pressured. Your time is soon coming. Just don’t lose focus.

Steps on How to Trade Forex with $50 to $100

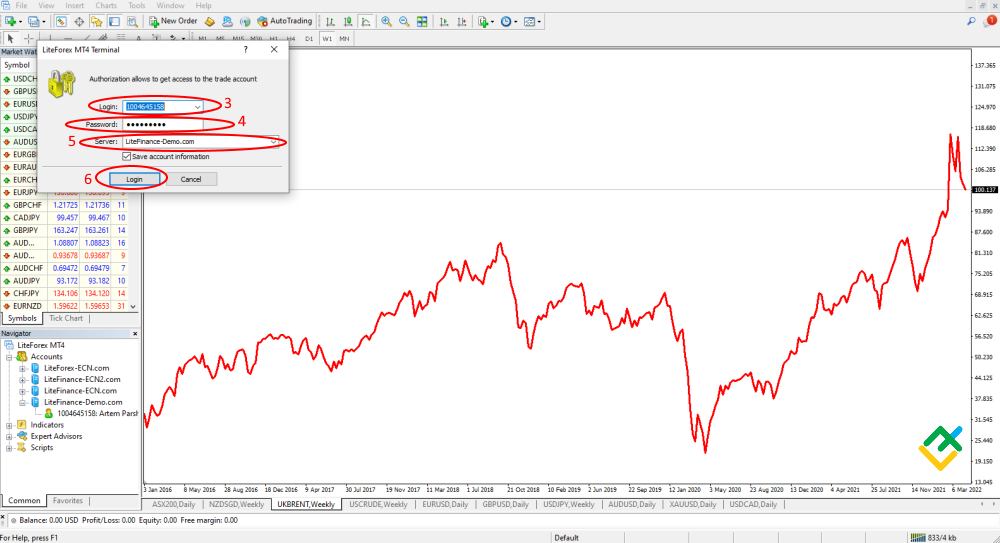

Step 1: Get Familiar with the Forex Trading Platform Using a Demo Account

A demo account is basically a simulation of a real Forex trading account. It works the same way as an actual account, offering the same features and tools.

However, instead of real money, you’re trading with virtual funds provided by the broker, which means all gains and losses are also virtual.

Benefits of Using a Demo Trading Account:

- With a demo account, Forex traders don’t have to worry about losing their own money. If you experience losses while trading, you can simply open a new demo account and continue practicing without any financial consequences.

- You can refill the demo account balance easily at any time. These accounts come with various technical features that allow you to try out different strategies and gain confidence in your trading methods.

They also let you evaluate the advantages, services, platform features, and any special tools a broker offers.

It’s smart to make your demo account balance similar to the amount you plan to invest in a live account. For example, if you aim to start with $100 in real trading, it’s better to set the demo account to $100 instead of $100,000.

The approach to risk, potential profits, and possible losses differs greatly between the two amounts. Training with a $100 demo balance gives you a more realistic sense of the conditions you’ll face when you go live.

Many traders make quick and risky decisions on demo accounts because they’re not afraid of losing real money. This careless mindset often carries over into live trading and can lead to serious losses. That’s why learning how to manage risks properly should be the first step when using a demo account.

Reasons to Use a Demo Account:

- To get a clear understanding of how the trading platform works and to learn about Forex trading in general.

- If you’re just starting and planning to trade with a small amount like $100, a demo account helps you grasp the basics before investing actual money.

- To build your trading experience, sharpen your instincts, and boost your decision-making skills.

- The more you use a demo account to trade, the more skilled and confident you’ll become, which increases your chances of doing well when you move to a live account.

- To experiment with different trading strategies, you can use tools like the built-in MT4 tester or Forex Simulator/FxBlue testers to try out both manual and automated strategies. This helps you check how strong your strategy is under pressure, how much profit it might generate, and how well it can handle unexpected situations.

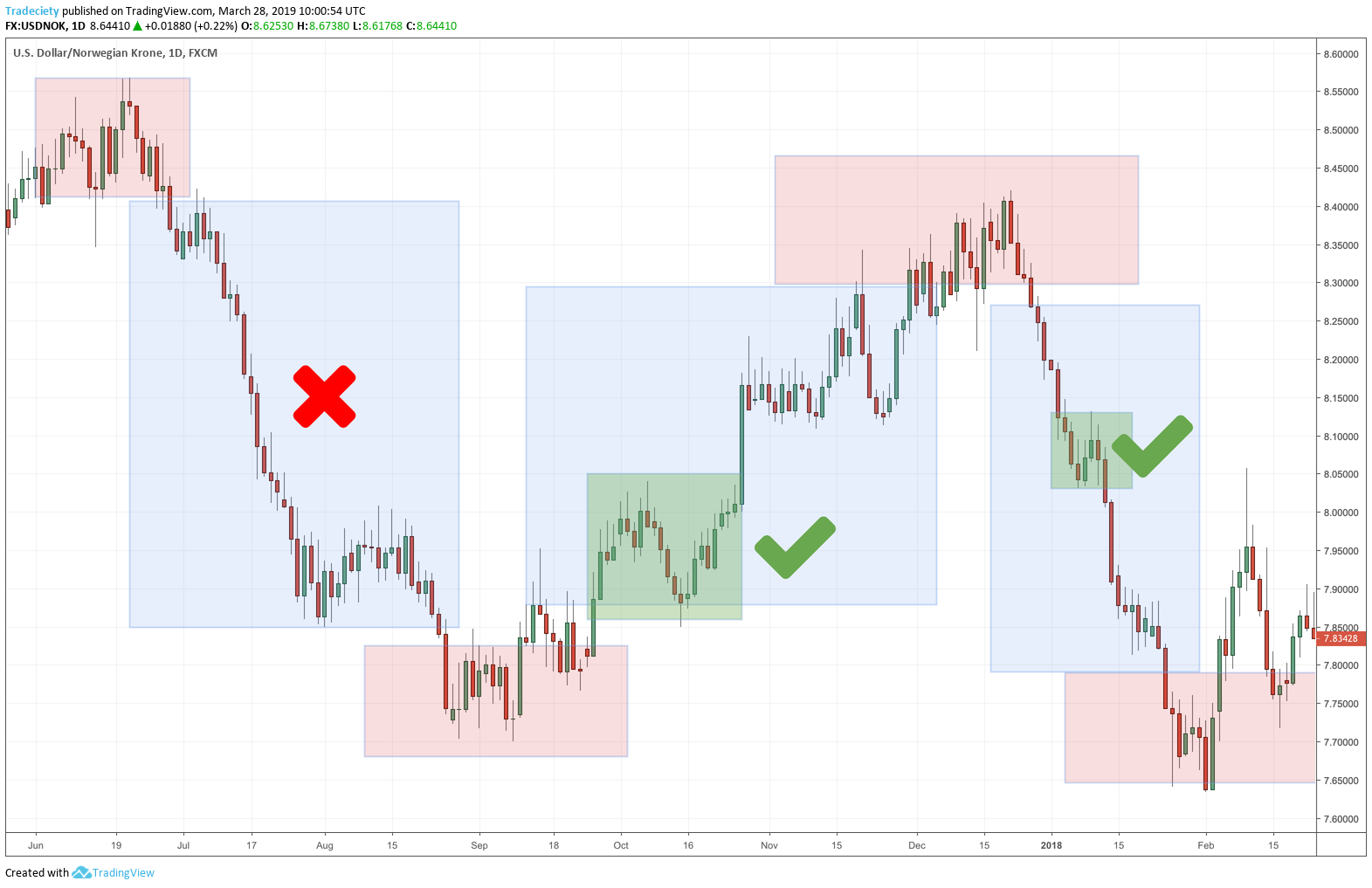

Step 2: Learn About the Forex Market

The outcome of trading Contracts for Difference (CFDs) relies heavily on how accurate your predictions are. At first glance, price charts may look random and unpredictable, but in reality, the market follows certain patterns.

For instance, news events can influence prices. When a company reports higher profits, traders often begin buying its shares, which increases demand and causes the stock price to rise. In other situations, many traders might exit their positions at the same price level to avoid risk.

This behavior is driven by herd psychology, often leading to trades being closed near strong resistance levels. A trader needs to recognize these patterns and use various analysis tools to predict price trends correctly.

Types of Forex Market Analysis:

- Technical analysis focuses on identifying patterns from the past with the idea that they might repeat. It uses formulas and statistical methods to spot potential trends.

- Graphical analysis deals with chart patterns, especially candlestick formations, that suggest future movements in currency prices. Tools include trend lines and areas of support or resistance.

- Fundamental and economic analysis involves studying data such as interest rate changes, inflation figures, job statistics, trade balances, and financial reports of companies.

- Psychological analysis is based on the idea that many traders react in similar ways as some rush to jump in at the last minute, others panic and sell quickly. Tools like the Market Sentiment Indicator help in understanding these behaviors.

- Wave analysis views the market as moving in long-term cycles or phases. Traders must identify which phase the market is currently in. A well-known example is the Elliott Wave theory.

Useful sources of information include: built-in and custom indicators, real-time news updates, data aggregators, websites with market statistics, online trader communities, financial blogs, economic and trading calendars, training videos, and broker tutorials.

Step 3: Add Money to Your Trading Account

Important! Before putting any money into your account, you must verify your identity and address. Sometimes, you also need to confirm your payment method to show that your card or wallet belongs to you. Using someone else’s bank account, card, or wallet to fund your trading account is not allowed.

Key things to consider:

- Check the minimum deposit you need to make and the lowest amount you can withdraw.

- Be aware of transaction fees (and whether your broker refunds any of them).

- Know how long it takes for funds to be added to your account.

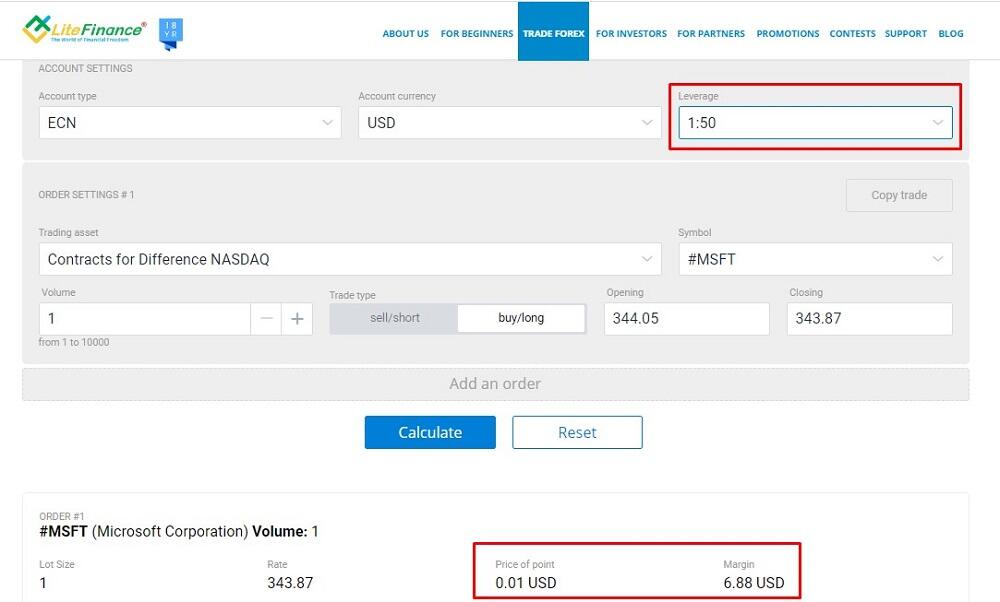

Step 4: Work Out the Margin Needed and Margin Level

Thanks to leverage in Forex trading, traders can borrow funds from a Forex broker without paying any interest. For instance, with a 1:10 leverage ratio, a trader who only has 100 USD can control 1,000 USD (100 × 10).

However, it’s important to follow good risk management practices, which recommend that no single trade should use more than 3–5% of the total account balance as margin.

Basic Rules for Margin Trading:

- The main goal of leverage is to lower the margin requirement, not to grow the size of the trading position.

- If you increase the trade size by using leverage, the value of each point movement also increases. For example, in a 0.01 lot EURUSD trade, a one-point price change would mean a 10-cent shift in value, either profit or loss. But if the volume is increased by 100 times, the one-point movement will now be worth 10 USD.

- Using too much leverage can cause overexposure and lead to trades being closed automatically due to losses. For example, in the EURUSD pair, which tends to move about 60 points during the day, increasing the volume too much can wipe out your deposit even with just a 10-point correction in price.

The most critical concept in leverage trading is margin. Margin is the amount of money a broker sets aside from your account when you open a position. Without leverage, the broker blocks the full value of the trade. With leverage, only a small portion is blocked.

To calculate margin and the value of a one-point price movement, you can use a Forex calculator. Just enter the trading asset, volume of the trade, and the leverage ratio you plan to use.

Step 5: Choose a Forex Trading Strategy

No trading strategy can promise 100% success, and there’s no such thing as a strategy that always makes a profit. What matters most is choosing a method that matches your trading goals, personality, and experience.

Some traders are comfortable sitting at their computers for long hours, making quick trades throughout the day. Others prefer higher-risk methods like trading cryptocurrencies. Some like to base decisions on economic reports and news.

Popular Forex Trading Strategies Include:

- Scalping – A fast-paced approach where traders open many positions and aim to make a small profit on each.

- Intraday Trading – Opening and closing trades within the same day to avoid overnight fees. This includes:

- Swing Trading – Based on market trends and volatility throughout the day.

- Channel Trading – Trading within a price range or during breakout moves.

- Long-Term Trading – Holding a position for a longer time, unlike the shorter timeframe of swing trading.

- News-Based Trading – Using economic data and events to guide trading decisions.

- Algorithmic Trading – Using automated software (expert advisors) to carry out trades.

Try experimenting with a few strategies using a demo account first. This will help you understand your preferred trading style and decide what works best for your needs.

You can watch the video below to see expert techniques used by top traders concerning ‘How to Trade Forex with $50 to $100’:

Limits of Trading Forex with Just $100

When starting forex trading with a deposit of $100, your chances and trading power are quite restricted.

- Profit Potential is Capped: Based on common risk management rules, the safest risk per trade is usually no more than 5% of your total balance.

- Trading Volume is Restricted: Even if you use the highest leverage possible, opening a full-sized standard lot trade won’t be an option.

- Trade Quantity is Limited: Trading many assets at the same time, placing grids of orders, or using high-speed trading advisors will be tough with this amount.

Although a $100 deposit helps practice and improve your skills in a real trading environment, the profit you get might not be enough to cover the time and energy you put into active trading. A different approach could be putting the $100 into stock market investments for the long term.

Statistics show that the S&P 500 index has had an average return of about 10% to 12% per year over ten years, even when including market dips. With compound interest, your $100 investment could grow roughly 2.5 times, reaching about $260.

Forex Trading Tips with a Minimum Deposit

Here are some suggestions for how to trade forex smartly with a $100 account:

- Begin with micro lots: By using leverage, you can make your trading size larger without needing more money.

- Avoid rushing to grow your account: Strategies like Martingale, doubling down, or pyramiding aren’t suitable for small accounts.

- Don’t fear early losses: Making errors when you’re new is normal. The point is to learn how real trading works. If a method that worked well in a demo doesn’t perform in real conditions, don’t quit. Keep practicing, and you’ll start understanding how to adjust your methods as markets shift. Losing $100 can simply be the cost of your learning. If you profit, that’s a sign of progress.

- Try new ideas, but test them first: Always experiment on a demo account before going live. No strategy works forever, so be ready to fine-tune your indicators and try fresh tools.

- Stay calm and don’t panic: If you lose money, avoid constantly refilling your account just to break even. Take a break, study what went wrong, and come back stronger.

- Set clear goals and divide them into smaller targets: For example, if you aim to double your money in five months, that means a 20% increase each month.

- Only trade with money you’re okay with losing: Never use your last savings for trading. Focus on building experience and consistent results. Profitable trades and steady account growth already count as success.

The Takeaway

Now you know how to trade forex with $50 to $100 without blowing your account. It is not about luck, and it is about skill and smart choices.

Use small lot sizes, and always set stop-loss orders. Stick to one or two good setups, and don’t chase trades. Very importantly, you must make sure to keep learning each day.

Also, use demo accounts to test new ideas, and read books and follow pro traders. Trading is a journey, and you will grow with time provided you are dedicated, disciplined, and focused on developing your trading knowledge every day.

Remember this tip – Very important: Slow wins are better than fast losses. Be patient. Be focused. You can do this.

Your account may be small today, but with care and wisdom, it can grow. Take action now, and start trading smart!